Real-time credit data for corporate banking

Avoid loan losses. Automate client reporting. Precise regulatory reporting.

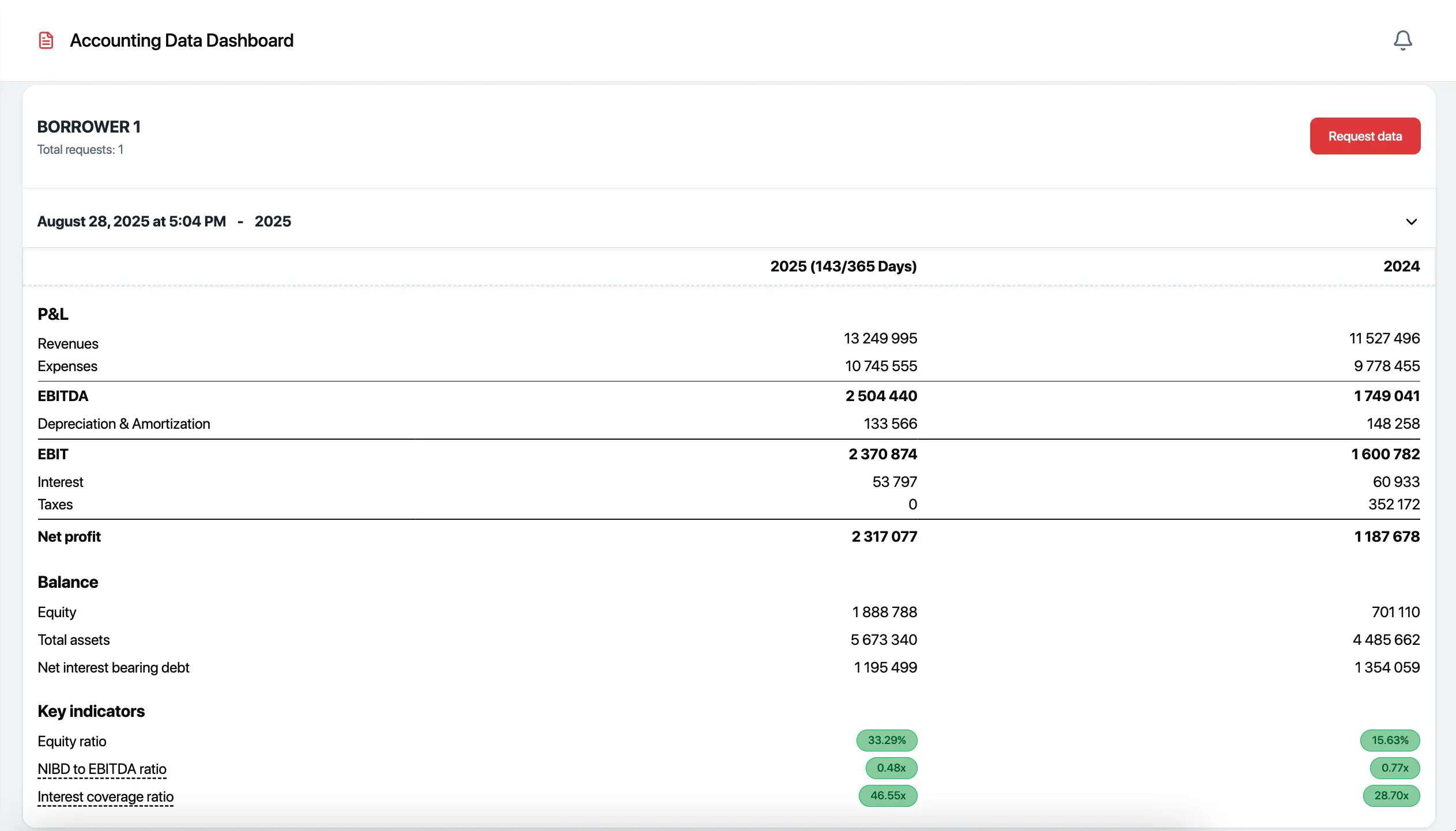

Accounting data in real-time

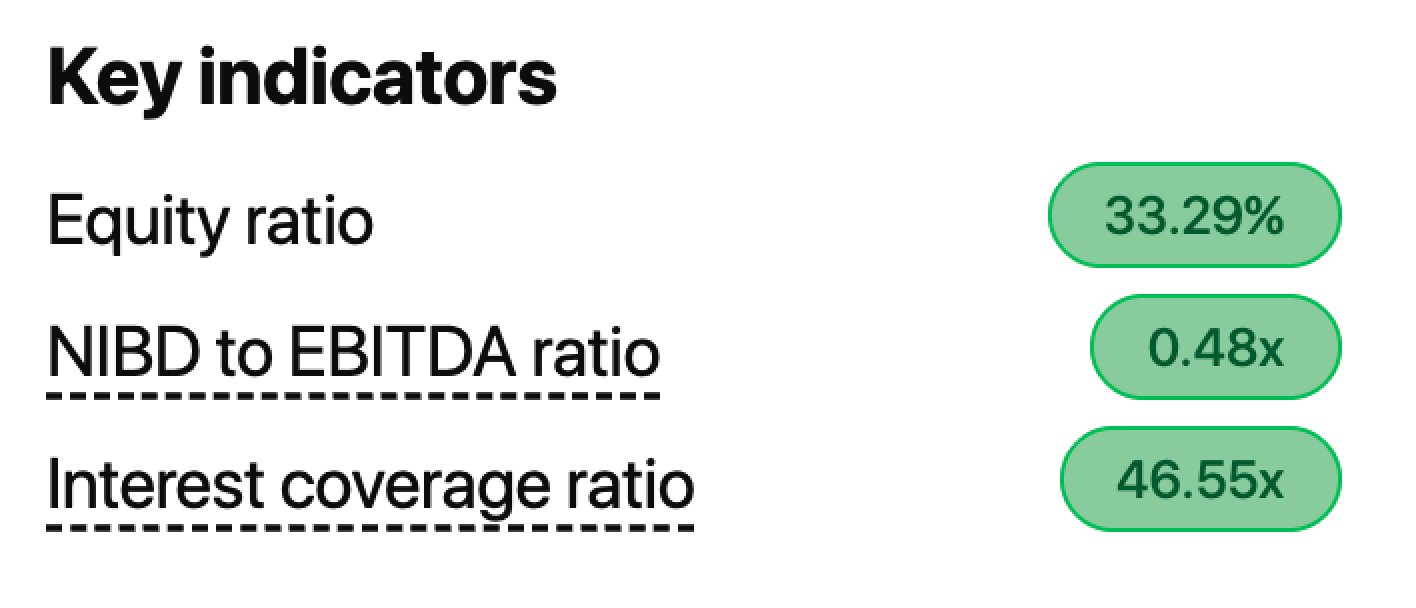

Company Monitoring

Snapshots of accounts and tracking of financial covenants

Asset Monitoring

Borrowing base functionality with ability to track security coverage in real-time

Portfolio view

All clients in one view and filters to identify clients that need attention.

Client view

- Track historical security coverage.

- Detailed breakdown of accounts receivables and inventory.

- Invoice distribution by due date and counterpart types.

- Apply default or custom haircuts to define risk adjustments.

Automate regulatory reporting

Export security values for regulatory reporting of Expected Loss (EL) and Loss Given Default (LGD).

Client Onboarding

Request client onboarding individually or by CSV. Clients are finalizing the onboarding of their API through a simple checklist

All clients in the same view - regardless of data source

Client data is primarily updated via API, with manual upload available for those without API.

| Data source | API connection | SAF-T upload |

|---|---|---|

| Fiken | ||

| Visma Eaccounting | ||

| Tripletex | ||

| PowerOffice GO |

High standards within security and compliance

Security

Information Security Management

- Following ISO 27001 principles

- ISMS function

- Comprehensive access control

- End-to-end cryptation

- Penetrations tests

DORA

Digital Operational Resilience Act

- Data stored within the EU

- Defined Service Level Agreements

- Exit procedures with data deletion

- Audit readiness

GDPR

General Data Protection Regulation

- Privacy Policy

- Data subject rights

- Consent management

- Data protection impact assessment

We strive to make it easy for corporate banks to benefit from real-time credit data

Our team has decades of experience from servicing corporate clients, credit processing, regulatory reporting, data management and delivering exceptional digital customer experiences.

Esten Solem

Chief Executive Officer

Nearly 20 years of experience from various positions in Danske Bank and DNB. Siviløkonom (NHH) and Master of Technology Management (NTNU/MIT).

Fredrik Medby Hagen

Chief Technology Officer

Extensive experience in project management, software engineering and startups. MSc in Computer Science with specialization in AI (NTNU). Post graduate diploma in Psychology and Neuroscience of Mental Health (King’s College London).

Knut Øvreås

Chairman

Extensive experience as Senior Manager in Nordea, Danske Bank and J.P. Morgan (CIB). Head of Business Development in Norsk Hydro. Head of Nordic Investments for Intrum AB. Siviløkonom (NHH).

Sondre Bjørnebekk

Board member

More than 20 years of experience building Cloud and SaaS software, used by millions of users. MSc in Computer Science (NTNU) and Master of Technology Management (NTNU/MIT).